By Nick Marshall

The volatile nature of cryptocurrency might put off some traditional investors, but others have spotted an opportunity to hedge against inflation. The theory is that Bitcoin, Ethereum and other leading decentralized currencies are more resistant to inflation than global currencies or commodities. Here’s what to know about inflation and cryptocurrency, and why you might want to ring-fence a portion of your investment portfolio using decentralized currency.

What Causes Inflation?

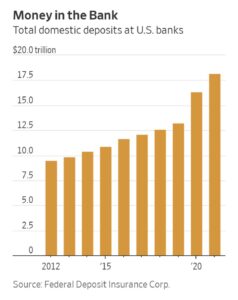

Fiat currencies such as the dollar or euro lose value over time, which in turn decreases the purchasing power of that currency for the holder, and drives up the costs of goods. The problem is that central banks and the Federal Reserve in the U.S. can increase the volume of currency in circulation by printing more money, something that governments did to the tune of $10 trillion in 2020 as a response to the pandemic. That’s why economic titans such as Milton Friedman have recognized that “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

Moderate amounts of inflation are not necessarily bad, so long as it is closely managed. The U.S. Federal Reserve, for example, targets 2% inflation to stimulate just enough consumer spending to maintain economic growth. Crucially, governments and treasuries have the tools and instruments to manipulate inflation through interest rate rises and money supply. They know that even when inflation rises sharply, investors will move their assets to more secure currencies, typically the U.S. dollar.

Why Should Crypto Be Different?

One hope was that crypto would provide a more inflation-proof way to hold assets, the digital counterpart to a traditional commodity like gold. Indeed the 2008 Satoshi Nakamoto white paper outlining the vision for Bitcoin announced it as an “inflation-free” currency. That’s primarily because, unlike the U.S. dollar, there is a limited supply of bitcoin available. Where there is scarcity, there cannot be inflation. The number of bitcoin in circulation will never exceed 21 million, while the mining reward will halve every four years from 2024 until all coins have been mined. That does not imply, of course, that scarcity eliminates volatility. There is by no means any guarantee that crypto assets will remain stable (or appreciate) during periods of rising inflation.

The other key strength behind cryptocurrency is that it falls outside the control of central banks. It belongs to no single treasury or reserve and is shared instead across a decentralized ledger. That means that financial institutions cannot hoard it, flood the market or otherwise manipulate the value.

In that sense, crypto is a good hedge against inflation. It may well attract scorn for its volatility, no more so than in May 2022, but citizens of countries that have suffered from hyperinflation, such as Venezuela or Argentina, would not exactly argue either that national currencies are any safer.

Where Fiat and Crypto Currencies Intersect

Clearly, the relative inflation-proof nature of cryptocurrency is not much of a virtue if the actual value is soaring or plummeting regularly. Bear in mind too that only some of the major types of cryptocurrency in the market involve a finite supply. Dogecoin numbers, for example, are unlimited. Ultimately, your assessment of cryptocurrency in terms of inflation will come down to whether you see it as a store of value or a means of payment. For the time being, it’s overwhelmingly the former, even if shops and online stores are increasingly accepting payments in bitcoin,Ethereum and others. The more that crypto crosses over into regular payments, the more it will be exposed to inflation.

At their best, cryptocurrencies can massively outpace traditional stocks but the two are completely different asset classes. With crypto, the token or coin is the asset, whereas with stocks, the value is pegged to the performance of a company, currency or commodity. With the U.S. government determined to bring cryptocurrency under greater centralized control, expect to see tighter regulation around the market, and favored status for stablecoins that are pegged to the U.S. dollar, such as Tether.

How To Fortify Your Portfolio

Crypto is still perceived as an immature investment, and there just isn’t enough historic data to draw solid conclusions as to whether decentralized finance can mitigate against inflation in the long term. May 2022 market conditions aside, prudent investors will usually aim to pursue a diversified strategy that balances traditional and crypto assets. In that scenario, it’s essential to give your crypto assets the same secure protection that you expect from your stock portfolio. Central to that is the establishment of an offchain title registry to prove ownership. To find out more about creating yours with TransitNet, sign up today.

Sources

Coinbase What is inflation?

Binance Cryptocurrency and Inflation: Everything You Need to Know

Coin Telegraph Bitcoin and inflation: Everything you need to know

CBBC – Biden just put out an executive order on cryptocurrencies — here’s everything that’s in it